Tinubu and the Trillion-dollar Economy by 2030- a leap of faith or another Jamboree?

By Abdullahi O. Haruna (Haruspice)

Tinubu’s administration has set its sights on a bold and transformative economic vision, reaffirming its commitment to bridging financial gaps and fostering inclusive growth across Nigeria. In a significant move to accelerate this agenda, Vice President Kashim Shettima inaugurated the Presidential Committee on Economic and Financial Inclusion, a strategic initiative aimed at positioning Nigeria as a trillion-dollar economy by 2030. The event, held at the State House Banquet Hall, also marked the signing of a landmark investment agreement under the Aso Accord Initiative, a key pillar of the administration’s Renewed Hope Agenda to reshape the nation’s financial landscape.

Speaking at the inauguration, Vice President Shettima underscored the need for deliberate action and strategic planning to achieve Nigeria’s economic aspirations. “Our road to a $1 trillion economy by 2030 shall remain a mere wish unless we lay a foundation strong enough to carry our dreams. Dreams are not built on hope alone. They are the sum of deliberate ideas and strategies, inspired by our desire to win,” he stated. His remarks echoed the administration’s determination to ensure that economic opportunities reach every Nigerian, particularly those historically excluded from the financial system. Since the launch of the Financial Inclusion Strategy in 2012, Nigeria has made commendable progress, improving inclusion rates from 60.3% to 74% as of 2023. However, beneath these figures lie the untold struggles of millions still locked out of the financial ecosystem.

The inauguration of the Presidential Committee on Economic and Financial Inclusion is not just another policy initiative; it is a national duty, a higher calling to bridge the economic divide and unlock the full potential of every Nigerian. The Vice President emphasized that while economic reforms come with short-term challenges, the government remains steadfast in mitigating these effects and expanding financial opportunities for all, regardless of geography or socioeconomic status. “This is not merely another government initiative. This is a higher calling, a national duty to bridge the economic divide and maximize the full potential of our people,” he asserted.

A critical aspect of this initiative is tackling systemic barriers that continue to exclude youth, women, micro, small, and medium enterprises (MSMEs), and rural populations from accessing financial services. The newly established Presidential Committee will operate through a Governance Committee and a Technical Committee, supported by an Implementation Secretariat to ensure that financial inclusion efforts are robust, strategic, and adaptable to evolving challenges.

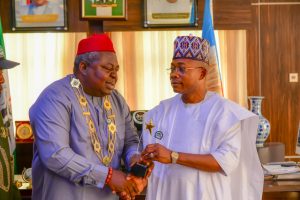

The private sector has also stepped forward as a crucial partner in this ambitious plan. At the signing of the Aso Accord investment agreement, IQS Africa led a consortium of investors committed to providing the essential infrastructure required to implement the initiative. This collaboration reflects the government’s recognition that public-private partnerships are vital to achieving its economic goals. The Deputy Chief of Staff to the President (Office of the Vice President), Ibrahim Hassan Hadejia, reinforced this point, highlighting that the committee’s composition—drawn from state governments, key ministries, departments, agencies, and the private sector—demonstrates a unified effort to attain Nigeria’s trillion-dollar economy target.State governments have also embraced the initiative, recognizing financial inclusion as a powerful tool for local economic transformation. Governor Peter Mbah of Enugu State noted that the state’s focus on financial inclusion has led to a significant increase in internally generated revenue, proving that integrating the underserved into the economy benefits both individuals and the broader financial system. Similarly, Kaduna State Governor, Senator Uba Sani, emphasized that financial inclusion is long overdue, particularly in the northern region, where inadequate digital infrastructure has perpetuated economic disparities. He welcomed the federal government’s efforts, praising Vice President Shettima’s visionary leadership in tackling these long-standing challenges.The private sector’s endorsement of this initiative further validates its potential to drive real economic change. Emmanuel Itapson, President and CEO of IQS Africa, described the Renewed Hope Agenda as a defining moment in Nigeria’s economic trajectory. “The agenda is a bold move to redefine the contours of opportunity and possibilities before the nation,” he remarked. His words reflect a growing consensus that financial inclusion is not just about banking services but about unlocking the full economic potential of all Nigerians.

As Nigeria advances toward its trillion-dollar economy goal, the success of this initiative will depend on strategic planning, seamless execution, and sustained public-private collaboration. President Tinubu’s administration has laid a solid foundation, but the road ahead demands undiluted commitment from all stakeholders. With a renewed sense of purpose and a clear vision for economic inclusion, Nigeria stands at the cusp of a financial revolution that will empower millions, drive sustainable growth, and redefine the nation’s economic future.