Why you should start investing today

There’s a Chinese proverb I think, goes like this: “The best time to plant a tree is 10 years ago, the next best time, is today”. There are many lessons to learn from this proverb, particularly concerning investing and the need to grow wealth.

In my last article, I wrote about the difference between starting a business and investment. I emphasized how an investment is different from starting a business so much that you can have your money working for you. Today, more than ever, investing is a necessity.

There are many reasons why investing is very important. It may help you to achieve financial freedom, earn passive income, diversify your income, or become wealthy. However, one of the chief reasons to invest is because of a common economic enemy we all have to battle with – Inflation.

The rich have found a way to defeat this enemy. This is why the likes of Otedola, Dangote, Ilonah, Alakija, and Jason Njoku (Irokotv) have found a way to combat this enemy by investing in many sectors of the economy.

What is Inflation?

Inflation, to keep it simple, is a rise in the prices of goods and services – a rise in the cost of living. This means the price of the things you buy continues to go up. It makes the value of your money (income) worthless relative to the price of goods and services.

The Nigeria Bureau of Statistics usually determines the inflation rate through a concept called Consumer Price Index (CPI) which is arrived at by calculating the price, and how much you spend on goods and services over time (Basket of Goods).

Almost everyone experiences inflation especially for basic commodities such as food, healthcare, and education. You would have noticed how the price of things you bought 12 months ago has suddenly or gradually increased. A common example is the price of rice in the market today.

What inflation does to you.

Inflation affects people’s quality of life over time. The value If your money suddenly becomes less valuable and you are forced to watch how you spend. As this happens, you have less purchasing power and you cannot afford the things you could afford before.

Most people start to have low purchasing power as time progresses. This is because of what inflation does to the value of their money. It is especially true when your income remains the same but the price of goods continues to rise.

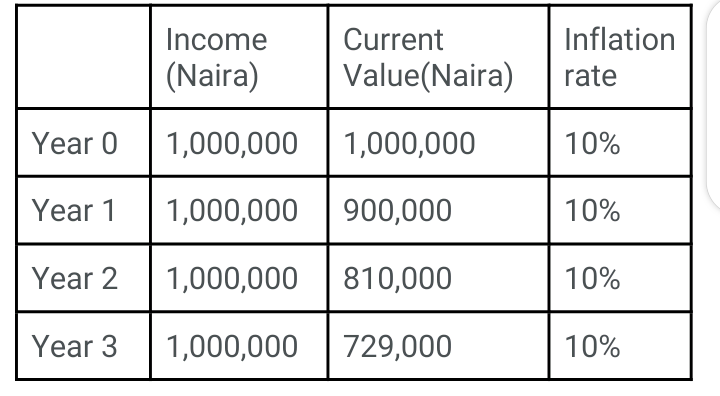

For most people, they do not get a promotion at the workplace or get a pay rise in at least three years. So for example, if you earn 1 million naira annually for three years where the inflation rate remains at 10% for each year, the value of your income reduces by 10% annually so that in three years time, your annual salary is now worth N729,000 in purchasing power even though you think you still earn 1 million naira.

The table below shows how this figure in the example above was arrived at.

Why Investing is key!

Investing helps you hedge your income against the effects of things like inflation, currency devaluation, etc by allowing you to earn interest on your money above the inflation rate. This way you are able to fight against inflation by either stabilizing your purchasing power, maintaining the value of your money, or even increasing it.

There are different ways to invest. For one, you can invest through savings by putting aside a certain percentage of your income monthly and investing it to earn interest. One of the most popular strategies is the 50-30-20 rule which I will write about in another article which can explain how you can set aside money from your income to invest.

Conclusion.

Investing is important if you want to be able to preserve the value of your income and also grow what you earn. It will help you hedge your income against things like inflation which, if not checked, reduces the value of your money over time.

If you plan to still be able to maintain your standard of living as time progresses, then you should consider investing as a way to achieve this.

You can reach out to me with your questions and I’ll be happy to help.

Email: nathaniel.okwoli@gmail.com

Whatsapp: 08111279035